-

Don't be the last one to know!

-

401(k) ROLLOVER STRATEGIES

-

FOR Retirement

-

New Year, New Approach with your 401(k). Grab a cup of coffee or tea and for the next 10 minutes,

-

let’s spend some time walking through 401(K) Strategies.

4 Key Takeaways From this Video to Guide You with

your 401(k) in retirement

If you hadn't had the chance to watch our 10 minute video, here are some key takeaways that you should consider with your retirement planning that is essential as you plan a comfortable retirement. On your Retirement Day, we help you feel confident as you begin this phase of your life. At Chamberlin, our mission is "Education in Action", and our goal is to empower you with the knowledge to help you make this next phase in your life exciting and secure. Here are the 4 key takeaways from the video:

- 1. Sequence of Returns Risk (The Invisible Threat): The danger that poor market performance early in retirement (the "Retirement Red Zone"—five years before and after retirement) can prematurely deplete a portfolio, even if the average return over the full retirement period is positive. The story of Sam and Sally illustrates that the timing of returns matters more than the average return when withdrawing income.

- 2. The Need to Switch from Saving Mode to Income Mode: Approaching retirement requires a strategic shift in how the 401(k) is managed. Relying solely on a market-dependent 401(k) for income is dangerous. A 401(k) rollover offers an opportunity to shift funds into a protected income strategy, a key step in building a Personal Pension.

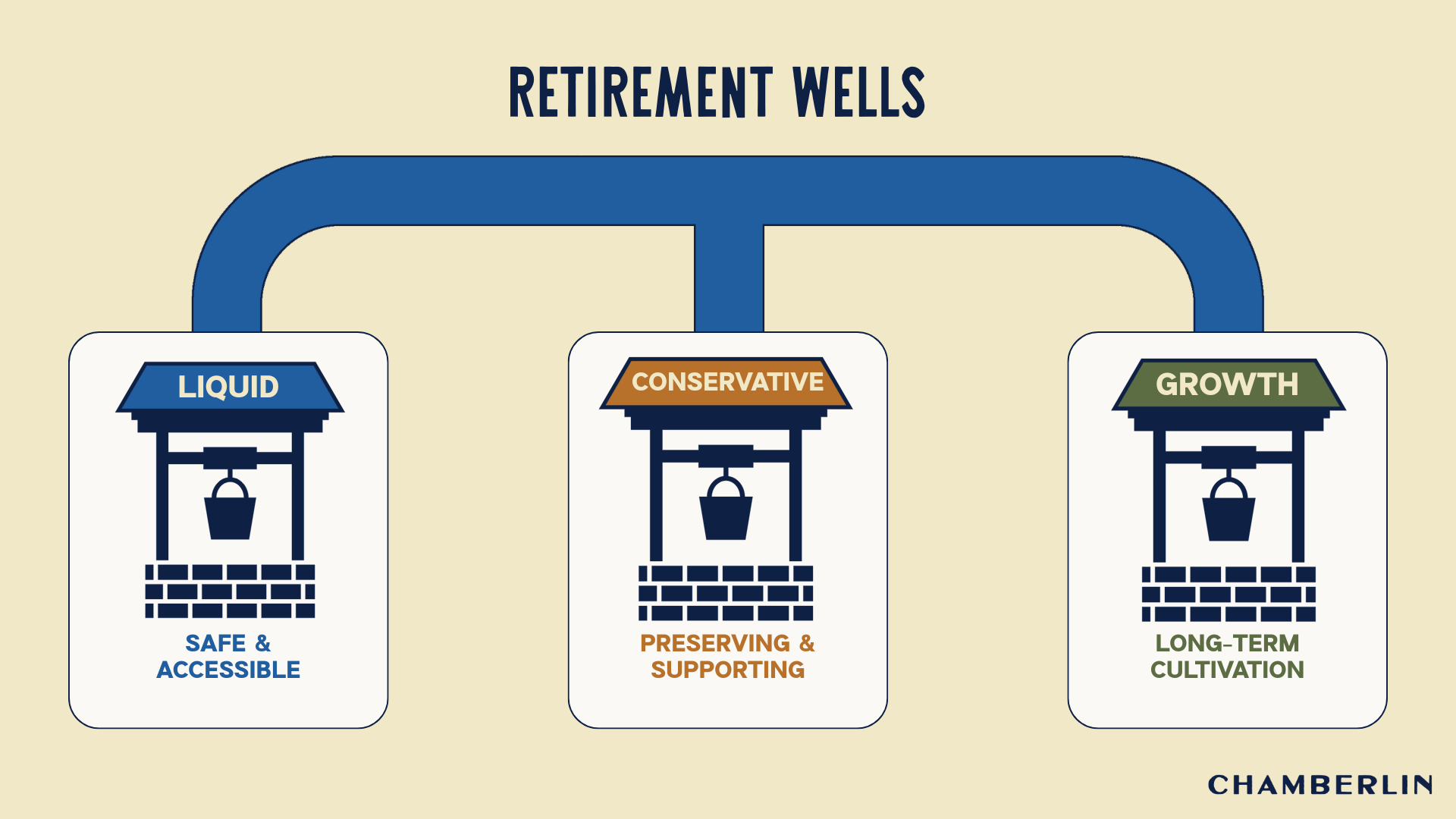

- 3. Holistic Planning and the Wells of Wealth Framework: A successful long-term retirement plan requires moving beyond simple investment and embracing a multi-part strategy for longevity and lifestyle. Our time segmentation wells strategy is to provide you with the framework to just do that, help give you a long-term retirement plan.

- 4. Tax-Smart Strategies (Roth and Unexpected Bills): Planning must address how switching to income mode affects tax bills. The VSL highlights the importance of being tax-smart, mentioning Roth accounts and the potential for rollover opportunities to minimize unexpected tax surprises in retirement.

What You’ll Get After the Call

ell The Reader More

You will find out how you can receive a No Cost, Mini Retirement Plan that includes 3 essential reports to maximise your nest egg with my Wells of Wealth approach. These are not generic reports. These are customized reports with your retirement wants and worries. We used to charge our clients $2,500 for these reports — $1,250 up front, and the other half afterward, to cover the cost of tailoring it to you and personalizing it with your numbers — but now we’ve made it complementary because we think it’s that important for you to have.

Optimizing Your 401(k) Rollover Strategy

The Wells of Wealth Approach

We use the “Wells of Wealth” approach to set aside safe money for your short-term needs, while ensuring that your investment portfolio continues to grow to address your medium and longer-term needs.

Our time segmentation wells strategy helps you rollover and allocate your retirement savings in a way that can help support your income needs, reduce risk, and optimize growth.

This structure helps you avoid tapping into volatile investments too early, while providing clarity and purpose for each dollar in retirement.

why we're different

Maximize Your 401(k) Rollover With A Holistic Approach

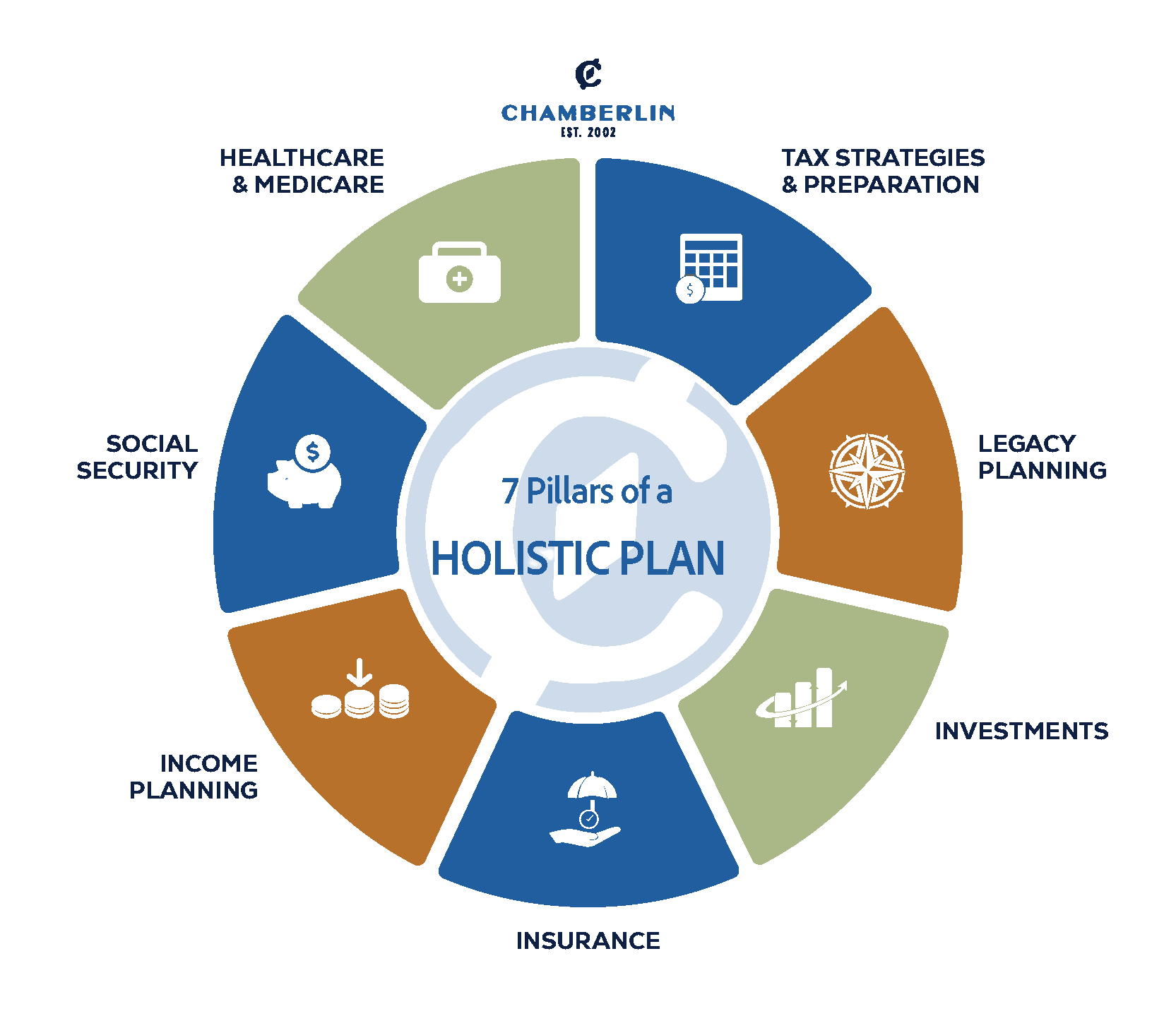

Retirement isn’t just about what to do with your 401(k). It’s about how every decision — investments, taxes, income, and healthcare — fits together to support your future. Our holistic planning approach ensures nothing gets left behind.

• Feel unsure about your rollover options?

• Worry about taxes or penalties from a wrong move?

• Need help coordinating your investments and income plan?

• Want to make a tax-smart decision that protects your future?

• Feel overwhelmed by too many choices?

• Want to work with a fiduciary who sees the full picture?-

We don’t just help you with your 401(k) — we guide you through every stage of retirement with clarity and confidence.

Interactive tools

Take an online assessment

Our online quizzes and calculators can help you set a baseline to start building your retirement roadmap.

• How close are you to retiring?

• What tax liabilities should be on your radar?

• What's your risk tolerance?

A Holistic Plan can help you take all of these answers into account for your financial future.

FAQ

Frequently Asked Questions About 401(k) Rollovers

in Retirement

1.

What is a 401(k) rollover?

A rollover is the process of moving your 401(k) funds into another retirement account—like an IRA—without triggering taxes or penalties.

2.

Should I roll my 401(k) into an IRA or leave it?

It depends on your goals. An IRA may offer more investment flexibility, but keeping funds in your 401(k) may provide unique benefits. We help you evaluate both.

3.

Will I owe taxes on a rollover?

If done correctly as a direct rollover, you won’t owe taxes immediately. Mistakes, however, can result in unexpected tax bills.

5.

How does a 401(k) rollover fit into my retirement plan?

It impacts everything from income to taxes and legacy. That’s why we fit rollover strategies into your full financial picture.

4.

What are the risks of a 401(k) rollover?

Poor timing, fees, and investment mismatches can all reduce your retirement income. That’s why having a strategy is critical.

6.

Can I roll over more than one 401(k)?

Yes, multiple 401(k)s from previous employers can be consolidated—helping you manage your assets more efficiently.

how we help

Continue Your Retirement Education

Navigating Social Security: Charting a Course for a Secure Retirement

The Social Security program is less than 100 years old, but it’s an institution that’s woven into many aspects of American life. How many of us have Social Security income...

The 7 Holistic Pillars of Retirement Planning with CFF Josh Reesman | The Retirement Planner Ep. 3

“I come from a family of educators, so I love how we do things here: Understand the options, educate people on the pros and cons of those different options, and then make some recommendations and give people an idea of what we think the best options might be for them.”

Explore Bucket Planning for Your retirement Strategy

Learn how strategic asset allocation can help manage financial security through different market conditions.