-

enhance financial security

-

bucket planning:

-

help mitigate market risk

- Learn How to Manage Your Retirement Funds Strategically to Help Reduce Exposure to Market Volatility.

Bucket Planning

Helping Empower you to retire on your terms

- Keeping up with financial news these days can be unnerving, especially if you’re close to or entering retirement.

-

There’s so much uncertainty and change in the economy right now, and sudden market declines are reflecting that. This economic environment, and the media coverage of it, can be scary, but this is the type of situation bucket planning is designed for.

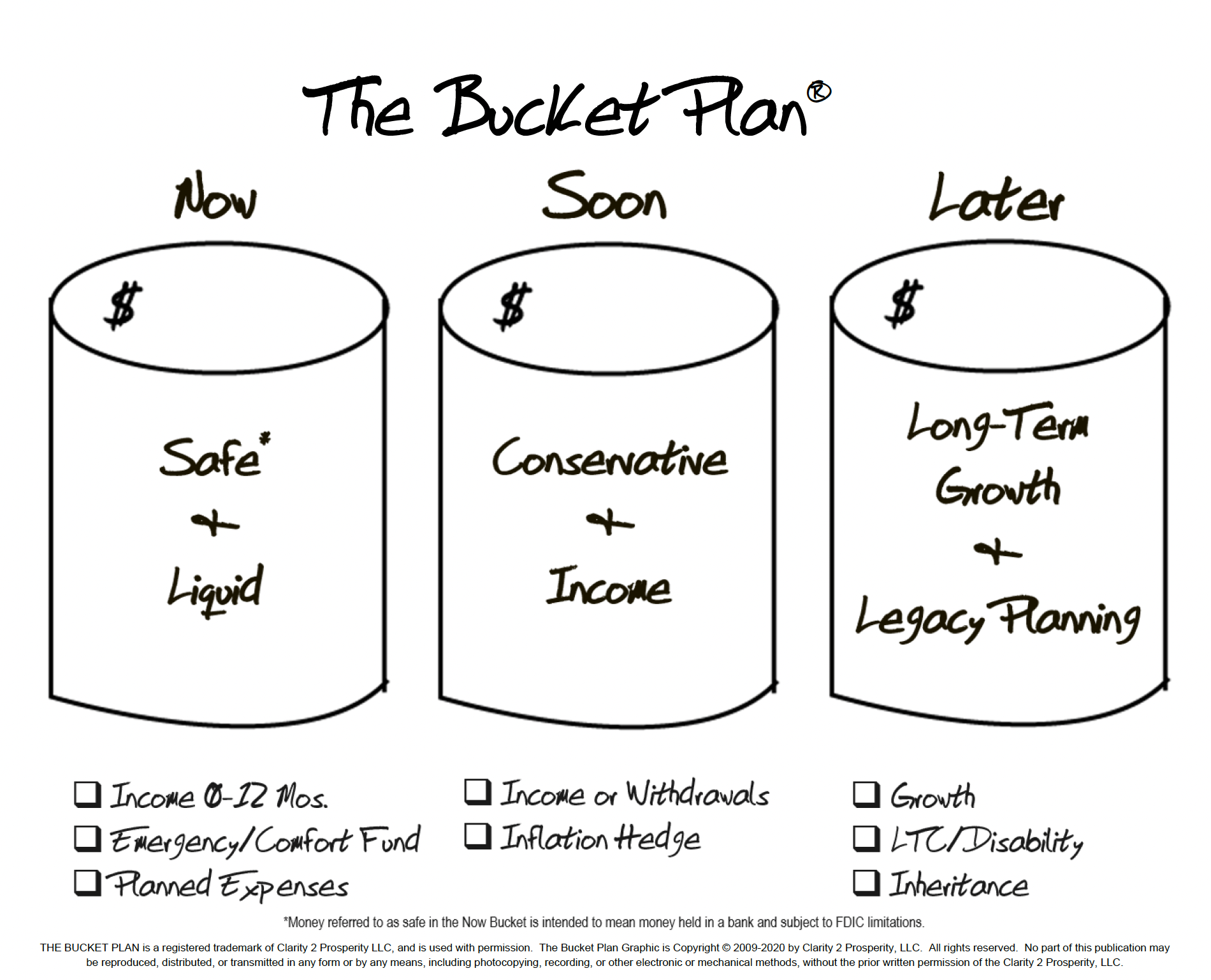

One of the biggest challenges in retirement is ensuring that your savings last throughout your lifetime, especially during periods of market volatility. Bucket Planning is a structured strategy that helps retirees allocate assets based on short-term, mid-term, and long-term retirement needs, ensuring a balance between liquidity, income stability, and growth potential.

strategy that works

The Bucket Plan

The Bucket Plan is a time-tested strategy that simplifies retirement planning by time-segmenting your wealth into three essential buckets.

This approach ensures you have the resources you need when you need them while maintaining a balance between immediate access and long-term financial stability.

Explore Bucket Planning for Your retirement Strategy

Learn how strategic asset allocation can help manage financial security through different market conditions.

Disclaimer

Financial Planning and Advisory Services are offered through Prosperity Capital Advisors ("PCA") an SEC registered investment adviser with its principal place of business in the State of Missouri. PCA and its representatives are in compliance with the current registration requirements imposed upon registered investment advisers by those states in which PCA maintains clients. PCA may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. This website is limited to the dissemination of general information pertaining to its investment advisory/management services. Any subsequent, direct communication by PCA with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. The Chamberlin Group and PCA are separate, non- affiliated entities. PCA does not provide tax or legal advice. For information pertaining to the registration status of PCA, please contact the firm or refer to the Investment Adviser Public Disclosure web site (www.adviserinfo.sec.gov). For additional information about PCA, including fees and services, send for our disclosure statement as set forth on Form ADV from PCA using the contact information herein. Please read the disclosure statement carefully before you invest or send money.