D

DEB

-

401(k) & RoTh Myths

-

FOR Retirement

- Traditional and Roth 401(k) plans and Roth conversions all come with their share of rules and considerations, and naturally, this leads to common myths and misconceptions. Let's debunk some of them.

avoid high taxes

We’ll help you save on

your 401k & IRA.

maximize your savings

Take charge of your finances with Social Security & Income Planning.

optimize your spending

We succeed when you achieve your goal of financial well-being.

Debunking Common Myths with your 401K

There is no “Magic Bullet” with your 401(k) and Roth Conversion strategies to optimize your retirement. Spend a few minutes with us as we debunk common myths and misconceptions with both traditional 401k plans and Roth accounts, as well as Roth conversions.

-

Myth Number One: My 401(k) is tax-free.

- The reality is that traditional 401(k) contributions are tax-deferred, meaning you don't pay taxes on the money until you withdraw it in retirement. You will pay income tax on withdrawals in retirement. Roth 401(k) contributions are made with after-tax money, so you’re not taxed on qualified withdrawals in retirement because you already paid taxes when you earned the money.

Myth Number Two: The money in my 401(k) is untouchable until retirement.

- The reality is that while early withdrawals generally incur penalties and taxes, exceptions exist to cover certain circumstances, such as medical costs, a first-time home purchase, or long-term disability. If your employer’s plan allows it, you can also typically take a loan from your 401(k), but these loans have specific rules, limits and risks depending on how the plan is structured.

Myth Number Three: Roth conversions are only for young people.

- The reality is that while converting earlier allows more time for tax-free growth, Roth conversions can be beneficial at any age, especially if you anticipate being in a higher tax bracket in retirement than you are now, or if tax rates are expected to rise. "Gap years" between retirement and required minimum distributions (RMDs) and/or Social Security can be ideal for conversions when income is lower.

Myth Number Four: Roth conversions are always a good idea.

- The reality is that while Roth conversions are a powerful tool, they aren't for everyone. And even if a conversion is right for you, the timing is important. Factors like your current and future tax brackets, access to cash to pay the tax bill, time horizon, life expectancy, and estate planning goals should all be considered. For example, if you plan to leave your IRA to charity, converting to a Roth might not be tax-efficient since charities don't pay tax on inherited IRA funds.

Optimizing Your 401(k) Rollover Strategy

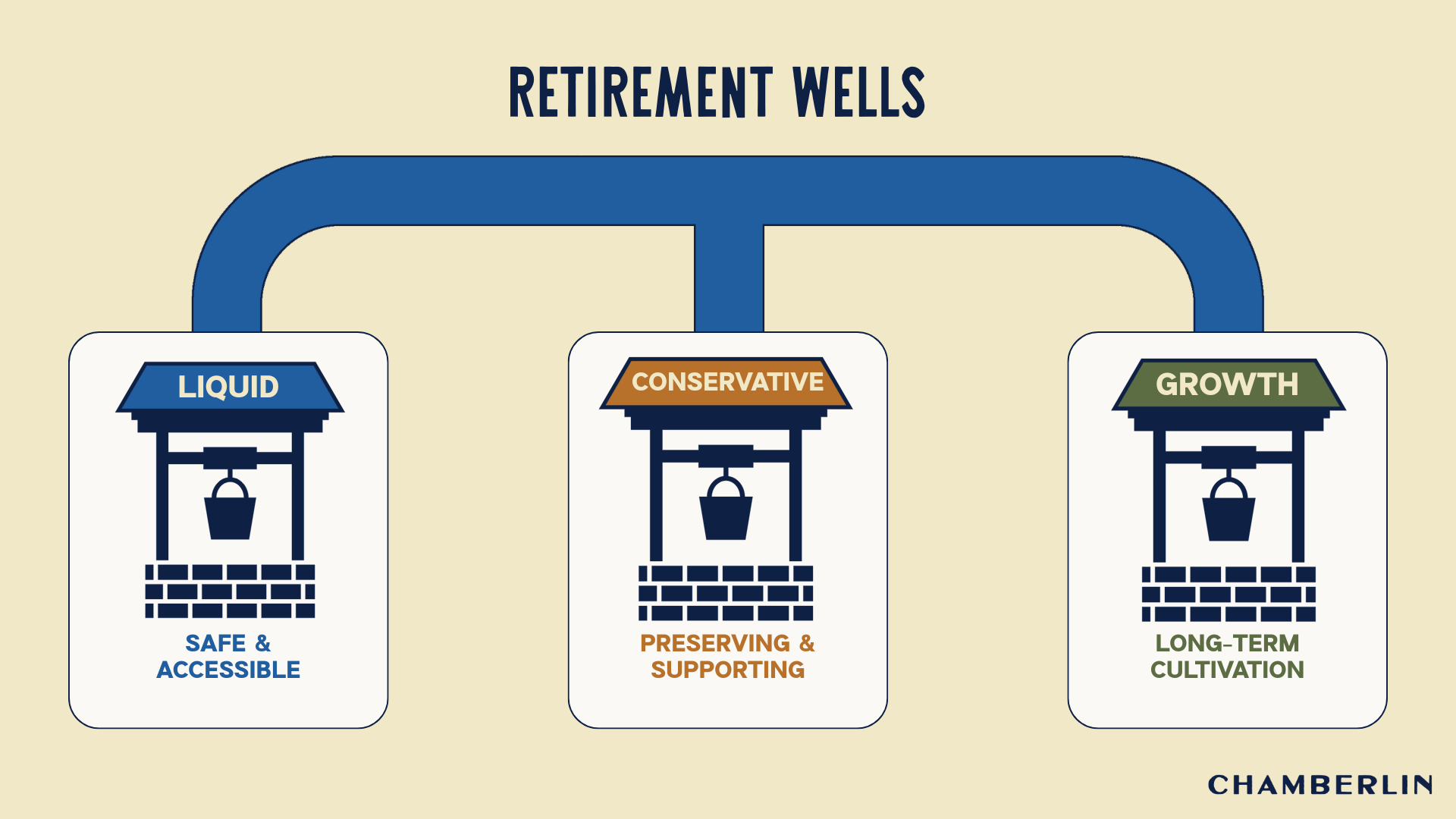

Wells of WealthTM

Your 401(k) is a powerful retirement asset, but only if used wisely. Our bucket planning strategy helps you rollover and allocate your retirement savings in a way that can help support your income needs, reduce risk, and optimize growth.

We divide your assets into three buckets:

• Now: Easily accessible cash for emergencies

• Soon: Income for the next 10 years

• Later: Long-term growth and legacy planning

This structure helps you avoid tapping into volatile investments too early, while providing clarity and purpose for each dollar in retirement.

why we're different

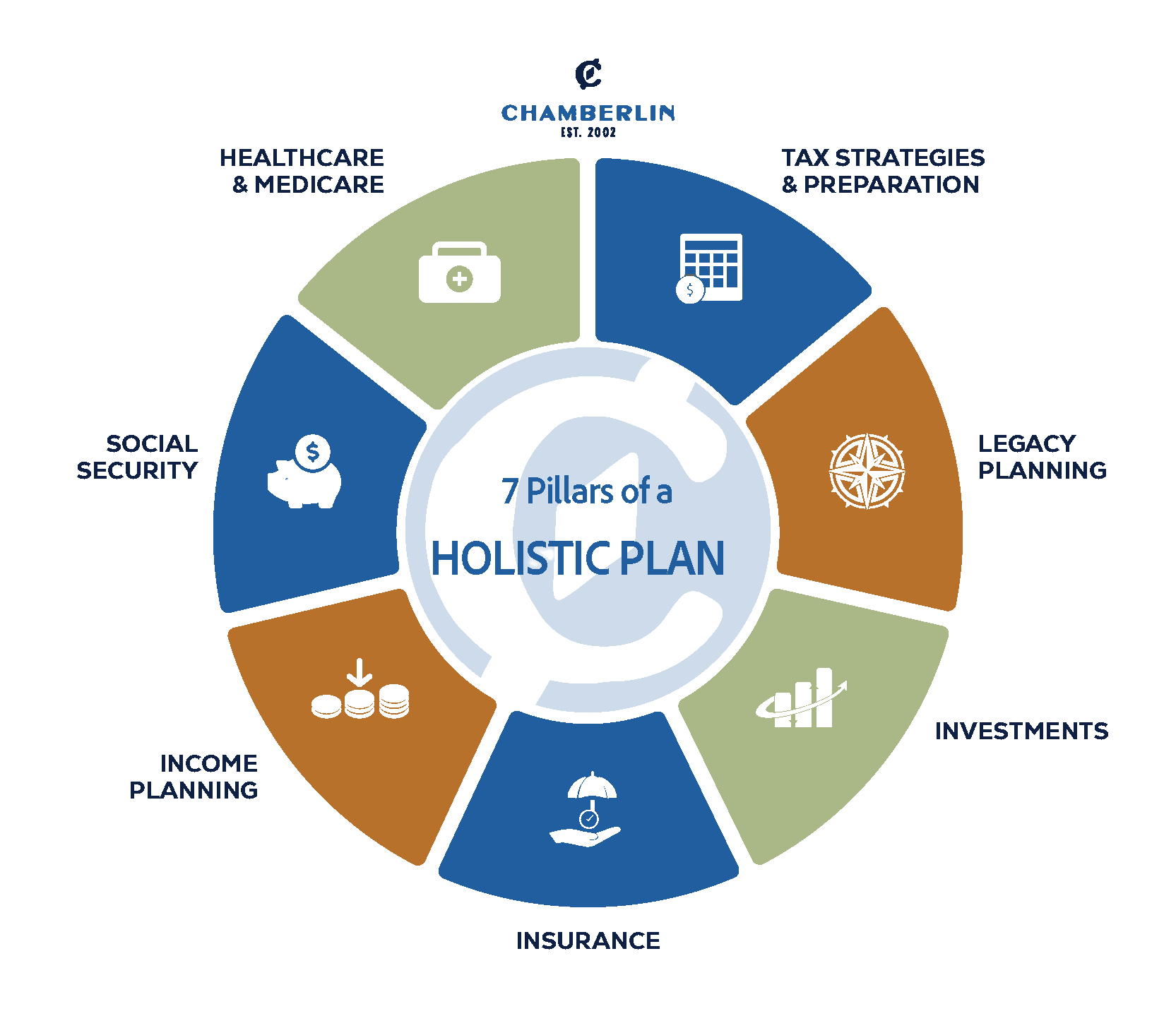

Maximize Your 401(k) Rollover With A Holistic Approach

Retirement isn’t just about what to do with your 401(k). It’s about how every decision — investments, taxes, income, and healthcare — fits together to support your future. Our holistic planning approach ensures nothing gets left behind.

• Feel unsure about your rollover options?

• Worry about taxes or penalties from a wrong move?

• Need help coordinating your investments and income plan?

• Want to make a tax-smart decision that protects your future?

• Feel overwhelmed by too many choices?

• Want to work with a fiduciary who sees the full picture?-

We don’t just help you with your 401(k) — we guide you through every stage of retirement with clarity and confidence.

FAQ

Frequently Asked Questions About 401(k) Rollovers in Retirement

1.

What is a 401(k) rollover?

A rollover is the process of moving your 401(k) funds into another retirement account—like an IRA—without triggering taxes or penalties.

2.

Should I roll my 401(k) into an IRA or leave it?

It depends on your goals. An IRA may offer more investment flexibility, but keeping funds in your 401(k) may provide unique benefits. We help you evaluate both.

3.

Will I owe taxes on a rollover?

If done correctly as a direct rollover, you won’t owe taxes immediately. Mistakes, however, can result in unexpected tax bills.

5.

How does a 401(k) rollover fit into my retirement plan?

It impacts everything from income to taxes and legacy. That’s why we fit rollover strategies into your full financial picture.

4.

What are the risks of a 401(k) rollover?

Poor timing, fees, and investment mismatches can all reduce your retirement income. That’s why having a strategy is critical.

6.

Can I roll over more than one 401(k)?

Yes, multiple 401(k)s from previous employers can be consolidated—helping you manage your assets more efficiently.

how we help

Continue Your 401(k) Education

Navigating Social Security: Charting a Course for a Secure Retirement

The Social Security program is less than 100 years old, but it’s an institution that’s woven into many aspects of American life. How many of us have Social Security income...

The 7 Holistic Pillars of Retirement Planning with CFF Josh Reesman | The Retirement Planner Ep. 3

“I come from a family of educators, so I love how we do things here: Understand the options, educate people on the pros and cons of those different options, and then make some recommendations and give people an idea of what we think the best options might be for them.”

Explore Bucket Planning for Your retirement Strategy

Learn how strategic asset allocation can help manage financial security through different market conditions.

Disclaimer

Financial Planning and Advisory Services are offered through Prosperity Capital Advisors ("PCA") an SEC registered investment adviser with its principal place of business in the State of Missouri. PCA and its representatives are in compliance with the current registration requirements imposed upon registered investment advisers by those states in which PCA maintains clients. PCA may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. This website is limited to the dissemination of general information pertaining to its investment advisory/management services. Any subsequent, direct communication by PCA with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. The Chamberlin Group and PCA are separate, non- affiliated entities. PCA does not provide tax or legal advice. For information pertaining to the registration status of PCA, please contact the firm or refer to the Investment Adviser Public Disclosure web site (www.adviserinfo.sec.gov). For additional information about PCA, including fees and services, send for our disclosure statement as set forth on Form ADV from PCA using the contact information herein. Please read the disclosure statement carefully before you invest or send money.