-

enhance financial security

-

Annuities:

-

Are they right for you

- Certified Financial Fiduciary Don Chamberlin explains the annual reset, growth lock-in and annual income factors of FIAs.

annuities

Are Annuities Right for You?

-

“Should I use annuities?” “I've heard so many bad things about annuities.” “I've heard people say I should never get an annuity,” or “I've heard people say annuities should be considered in retirement.”

Here at Chamberlin, we hear these questions and sentiments a lot. Annuities are a mystery to many retirees and pre-retirees, and we want to help you understand what they are and how they work — they’re not right for everyone, but once you’ve learned more about them, we hope you can make an informed decision about whether or not they’re right for you.

Read our in-depth blog "An Annuities Q+A: Are These Investments Right For Your Retirement?"

strategy that works

The Bucket Plan & Annuities

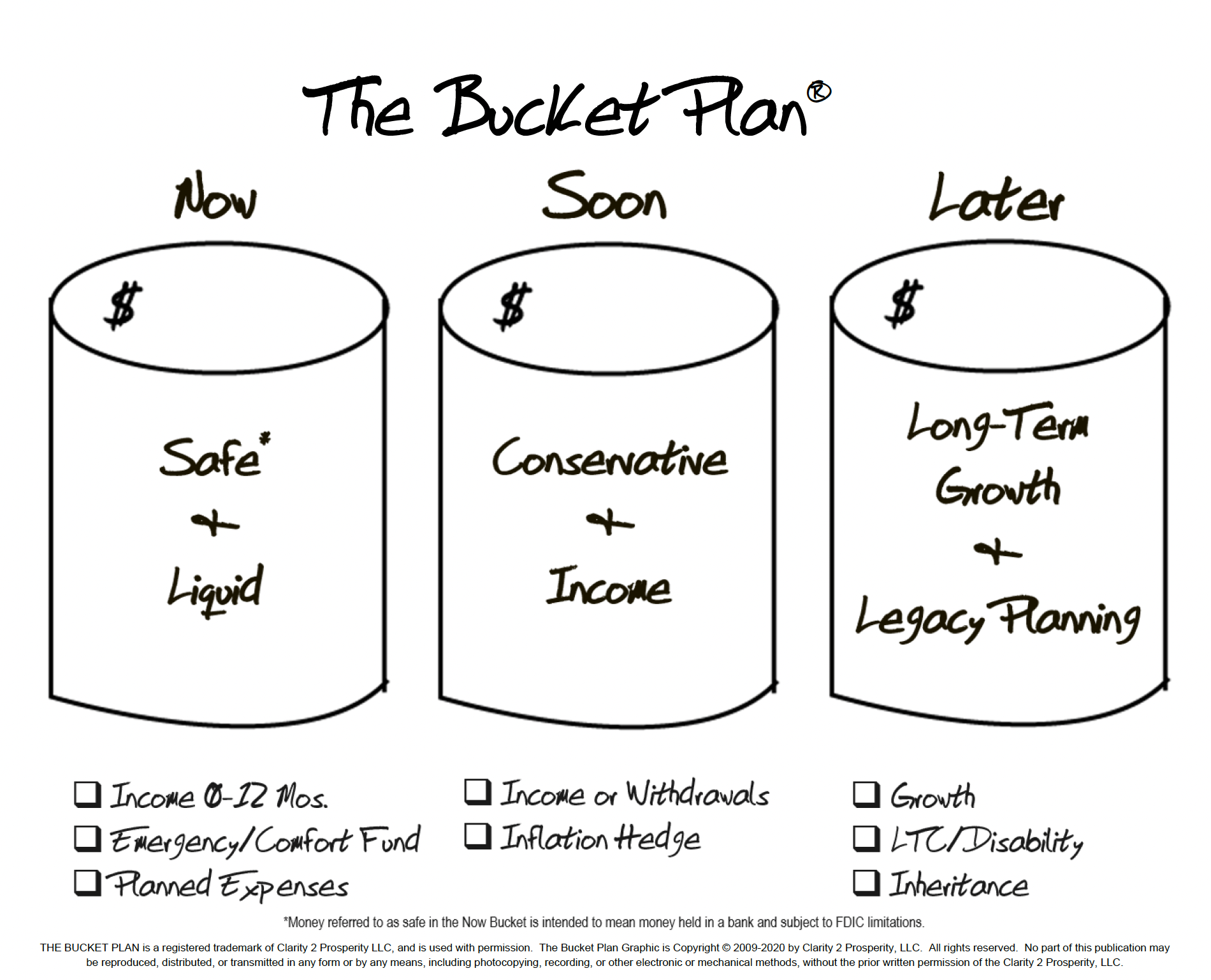

The Bucket Plan is a time-tested strategy that simplifies retirement planning by time-segmenting your wealth into three essential buckets.

As you can probably tell from the descriptions of the various types of annuities, the type, structure and particular investments, rules and details of each annuity mean they might make sense in more than one of your buckets.

This approach ensures you have the resources you need when you need them while maintaining a balance between immediate access and long-term financial stability.

Explore Bucket Planning for Your retirement Strategy

Learn how strategic asset allocation can help manage financial security through different market conditions.

Disclaimer

Financial Planning and Advisory Services are offered through Prosperity Capital Advisors ("PCA") an SEC registered investment adviser with its principal place of business in the State of Missouri. PCA and its representatives are in compliance with the current registration requirements imposed upon registered investment advisers by those states in which PCA maintains clients. PCA may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. This website is limited to the dissemination of general information pertaining to its investment advisory/management services. Any subsequent, direct communication by PCA with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. The Chamberlin Group and PCA are separate, non- affiliated entities. PCA does not provide tax or legal advice. For information pertaining to the registration status of PCA, please contact the firm or refer to the Investment Adviser Public Disclosure web site (www.adviserinfo.sec.gov). For additional information about PCA, including fees and services, send for our disclosure statement as set forth on Form ADV from PCA using the contact information herein. Please read the disclosure statement carefully before you invest or send money.