-

stay prepared, stay secure

-

retirement planning

-

in a volatile market

- Learn Smart Strategies to Help Manage Market Volatility & Protect Your Retirement Future.

Bucket Planning

Helping Empower you to retire on your terms

There’s so much uncertainty and change in the economy right now, and sudden market declines are reflecting that. Market volatility is inevitable, but uncertainty does not have to define your retirement. A well-structured retirement plan accounts for fluctuations in the market, helping you stay focused on long-term financial security rather than short-term changes.

At Chamberlin, we offer personalized retirement planning guidance tailoted to your goals. Bucketing is a structured strategy that helps retirees allocate assets based on short-term, mid-term, and long-term retirement needs, ensuring a balance between liquidity, income stability, and growth potential.

strategy that works

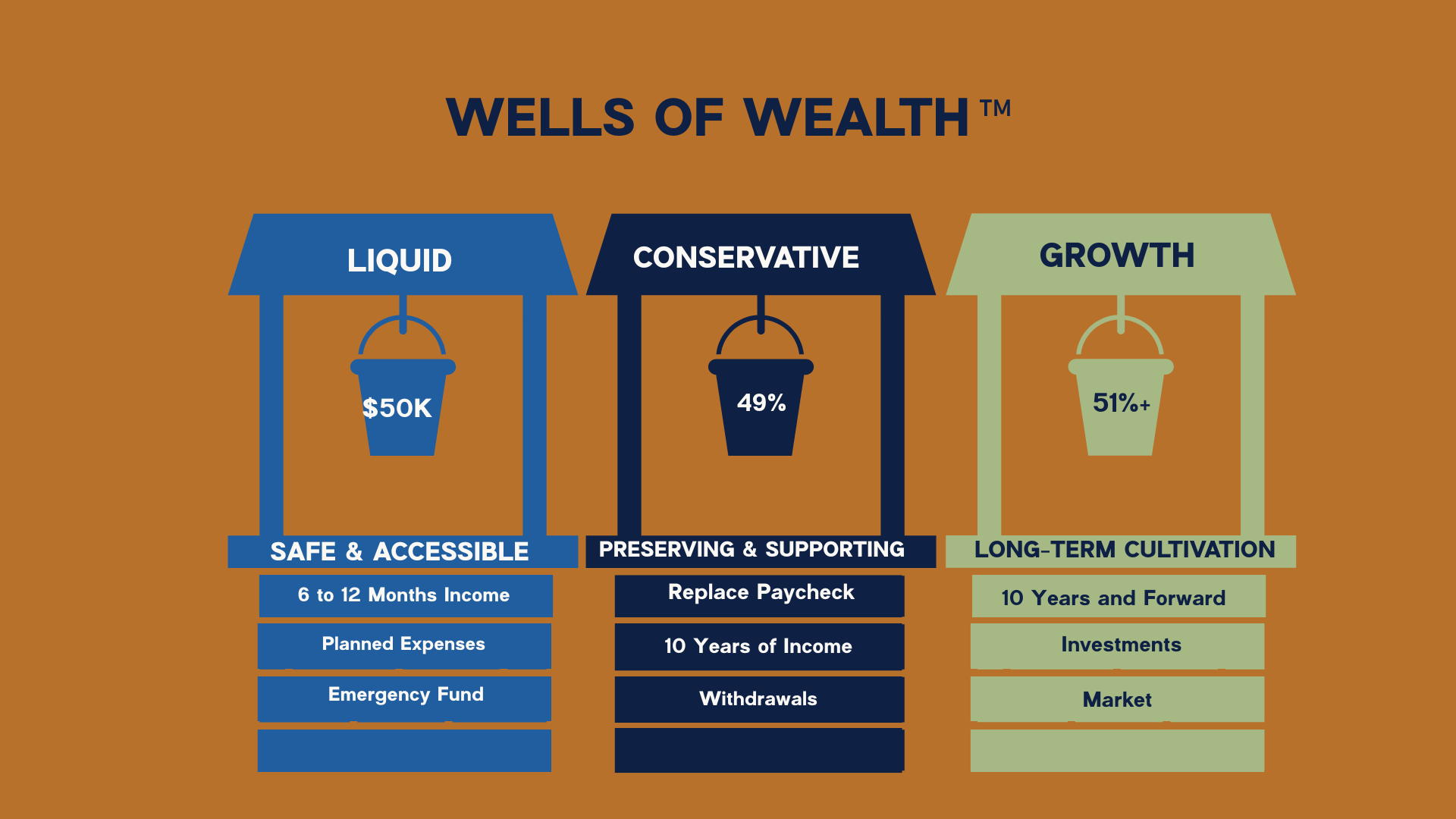

Wells of WealthTM

The Wells Of Wealth is a time-tested strategy that simplifies retirement planning by categorizing your wealth into three essential wells.

This approach ensures you have the resources you need when you need them while maintaining a balance between immediate access and long-term financial stability.

Explore Bucket Planning for Your retirement Strategy

Learn how strategic asset allocation can help manage financial security through different market conditions.