-

CLAIM SMART, RETIRE CONFIDENT

-

Social Security

-

in Retirement

- Social Security is one of the most important decisions in retirement, but also one of the most misunderstood. We can help you explore your options, avoid costly mistakes, and claim with confidence.

avoid high taxes

We’ll help you save on

your 401k & IRA.

maximize your savings

Take charge of your finances with Social Security & Income Planning.

optimize your spending

We succeed when you achieve your goal of financial well-being.

One Big Beautiful Bill Impact on Social Security

The "One Big Beautiful Bill (OBBB)" was signed into law on July 4, 2025. It contains several key provisions that can affect retirees drawing Social Security:

Senior Tax Deduction

The law introduces a $6,000 deduction for individuals aged 65+ (or $12,000 for married couples), potentially reducing or eliminating federal income tax on Social Security benefits.

- Eligibility: Full deduction for incomes under $75,000 (single) or $150,000 (couples); phases out entirely at $175,000 (single) and $250,000 (couples).

- Impact: Expected to result in 88% of seniors paying no federal tax on their Social Security benefits, up from 64% prior to the legislation.

- Duration: The deduction is temporary and set to expire in 2028.

Additional Tax Changes

- Tips and Overtime: Provides a deduction covering certain tips and overtime pay for workers earning less than $150,000, capped at $25,000 each.

- Child Tax Credit: Permanently increases the child tax credit to $2,200.

- State and Local Tax (SALT) Deduction: Temporarily increases the SALT deduction cap to $40,000 in 2025 before reverting.

Social Security Fairness Act

Signed into law on Jan. 5, 2025Key Changes:

- Repeal of WEP and GPO: Eliminates the Windfall Elimination Provision and Government Pension Offset.

- Beneficiaries: Affects approximately 3 million public servants, including teachers, firefighters, and police officers.

- Benefits: Eligible individuals may see monthly increases averaging $360, with retroactive payments for 2024.

Important Reminders

- No Immediate Action Required: Affected beneficiaries will receive adjustments automatically.

- Stay Informed: Visit www.ssa.gov or create a 'my Social Security' account.

strategy that works

Wealth of WellsTM

Social Security in Retirement is a cornerstone of your income strategy, and our time-tested approach simplifies the decision-making process by aligning your benefits with your retirement timeline.

We segment your income needs into three stages:

• Liquid: Accessible cash for immediate needs

• Conservative: Conservative assets supporting income (including the right timing for benefits)

• Growth: Growth and legacy planning—while continuing to help protect your income foundation

This structure helps you claim Social Security at a time that supports your lifestyle, tax efficiency, and long-term financial goals.

why we're different

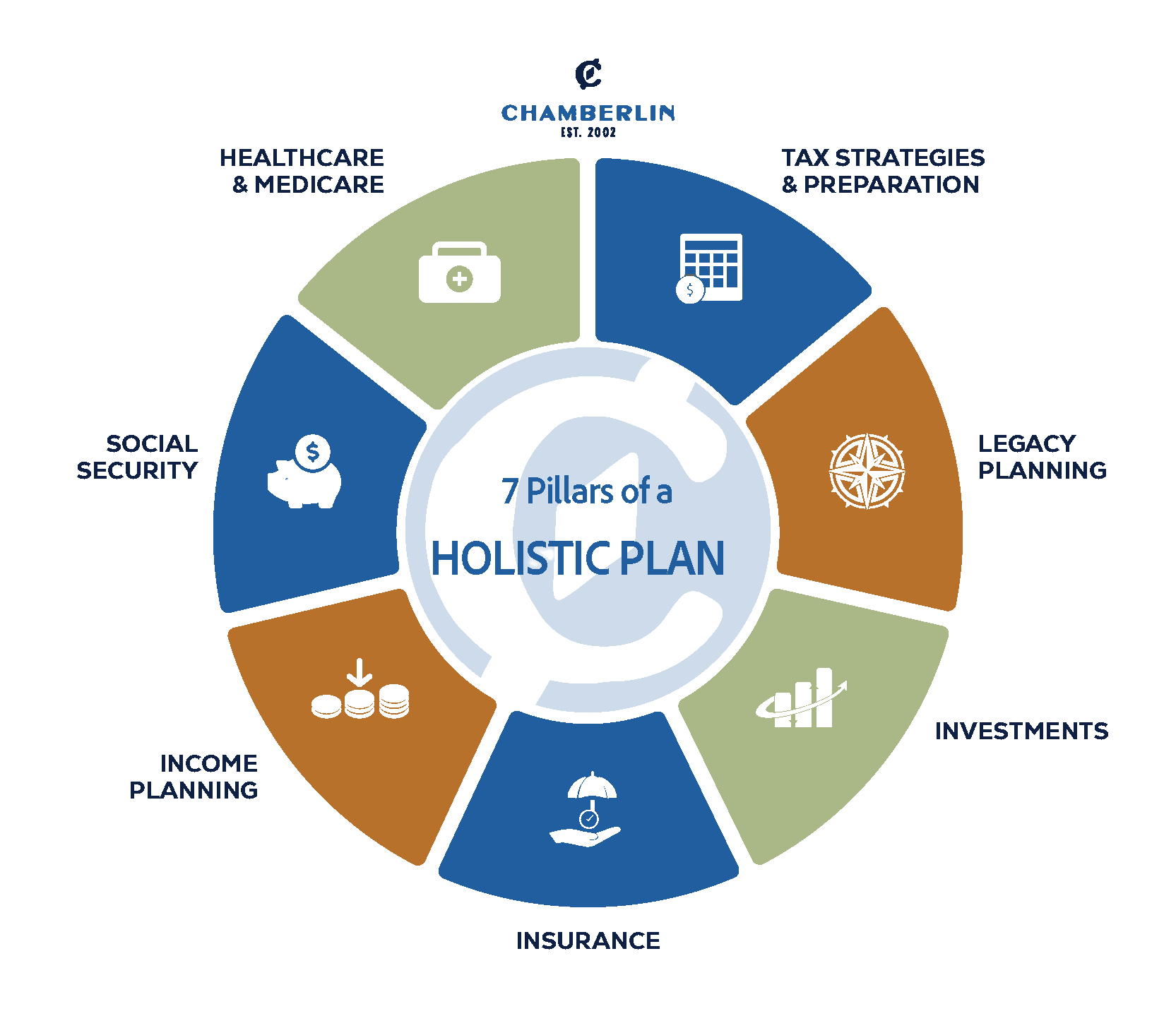

Maximize Your Social Security With A Holistic Approach

Retirement is one of life’s biggest transitions, and Social Security impacts more than just your monthly check. From taxes to Medicare to legacy planning, our team helps you make informed decisions that work across your entire plan.

• Feel unsure about the right time to claim

-

• Want to coordinate with a spouse’s benefits

-

• Wonder if working longer will reduce your income

-

• Are concerned about taxes or future benefit cuts

-

• Need help aligning Social Security with your investments

• Want professional guidance from a fiduciary advisorOur approach goes beyond just claiming — we work to integrate Social Security into your full retirement plan to help you protect your lifestyle and your legacy.

FAQ

Frequently Asked Questions About Social Security in Retirement

1.

When should I claim Social Security?

That depends on your age, income needs, health, and goals. We’ll walk you through your options and help you choose confidently.

2.

Will I get taxed on Social Security?

Possibly. If you have other income, part of your benefit may be taxable. Smart timing and coordination can reduce this.

3.

Can I change my claiming decision?

In some cases, yes. There are limited windows where changes are possible. We help you avoid missteps and explore your best options upfront.

5.

What if I keep working after I start benefits?

Earnings may temporarily reduce benefits if you claim before full retirement age. But once you reach it, those reductions stop.

4.

Do spousal benefits affect my own?

They can. Spousal and survivor benefits have special rules. We help couples coordinate to maximize both benefits over time.

6.

How does Social Security fit into my bigger plan?

It’s just one piece of the puzzle. We align it with your investments, taxes, and long-term goals for full-picture clarity.

how we help

Continue Your Social Security Education

Navigating Social Security: Charting a Course for a Secure Retirement

The Social Security program is less than 100 years old, but it’s an institution that’s woven into many aspects of American life. How many of us have Social Security income...

The 7 Holistic Pillars of Retirement Planning with CFF Josh Reesman | The Retirement Planner Ep. 3

“I come from a family of educators, so I love how we do things here: Understand the options, educate people on the pros and cons of those different options, and then make some recommendations and give people an idea of what we think the best options might be for them.”

Explore the Wells of WealthTM

For Your retirement Strategy

Learn how strategic asset allocation can help manage financial security through different market conditions.